Calculate Equipment Savings With a Section 179 Deduction

Did you know? In the United States, the IRS allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year. This can save entrepreneurs like yourself a lot of money, and it effectively reduces the cost of your equipment.

While previously, businesses would write off equipment over the course of several years, you can now deduct the entire purchase price the year you buy it.

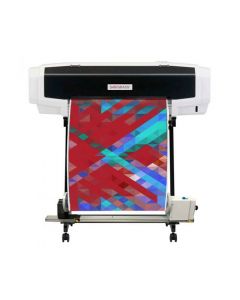

This means that if you purchase or finance a dye-sublimation printer for $7,500 and your tax bracket is 21%, your tax savings are $1,575 (21% of the total price). This reduces the cost of the printer to just $5,925.

Use the calculator below to calculate your savings on a new piece of a equipment using the Section 179 Deduction.

How Does Section 179 Work?

Section 179 is a part of the U.S. tax code that allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year, rather than depreciating it over time.

This means you could see substantial tax savings in the same year you make your investment.

Now Is the Perfect Time to Invest Or Upgrade!

- Increase Efficiency: Upgraded equipment can help you produce more, increase production, and provide consistent results time after time.

- Grow Your Business: Diversify your offerings with high-quality heat transfer equipment that meets customer demand for custom apparel, signage, home decor, and promotional blanks.

- Stay Competitive: Access to state-of-the-art tools and technology allows you to keep up with industry trends and consumer expectations.

*Crio 9541WDT Estimate.

Savings of up to $3,044.00!

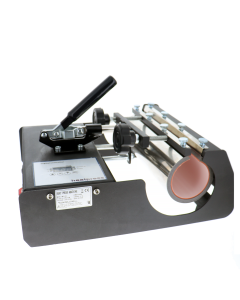

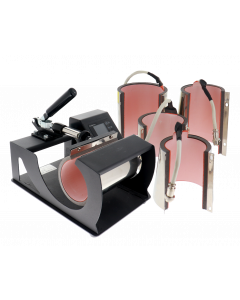

Shop Heat Press Equipment -

Shop Heat Transfer Equipment -

-

OKI Pro6410 NeonColor Laser Printer - CLEARANCESpecial Price $1,000.00 Regular Price $2,405.50

OKI Pro6410 NeonColor Laser Printer - CLEARANCESpecial Price $1,000.00 Regular Price $2,405.50 -

Epson SureColor F570 Pro 24" Desktop Sublimation PrinterSpecial Price $2,745.00 Regular Price $2,995.00

Epson SureColor F570 Pro 24" Desktop Sublimation PrinterSpecial Price $2,745.00 Regular Price $2,995.00 -

Crio 8432WDT Powderless DTF+ Printer - Starter BundleSpecial Price $7,495.00 Regular Price $7,995.00

Crio 8432WDT Powderless DTF+ Printer - Starter BundleSpecial Price $7,495.00 Regular Price $7,995.00 -

Crio 8432WDT Powderless DTF+ - Pro BundleSpecial Price $8,795.00 Regular Price $9,995.00

Crio 8432WDT Powderless DTF+ - Pro BundleSpecial Price $8,795.00 Regular Price $9,995.00 -

Epson SureColor F1070 DTG / DTF PrinterSpecial Price $5,995.00 Regular Price $7,495.00

Epson SureColor F1070 DTG / DTF PrinterSpecial Price $5,995.00 Regular Price $7,495.00

-

Epson SureColor F9570 64" Dye-Sublimation PrinterSpecial Price $27,995.00 Regular Price $29,995.00

Epson SureColor F9570 64" Dye-Sublimation PrinterSpecial Price $27,995.00 Regular Price $29,995.00 -

Epson SureColor F9570H 64" Dye-Sublimation PrinterSpecial Price $32,995.00 Regular Price $34,995.00

Epson SureColor F9570H 64" Dye-Sublimation PrinterSpecial Price $32,995.00 Regular Price $34,995.00 -

64" 4-Color DGI Poseidon Sublimation PrinterSpecial Price $39,750.00 Regular Price $54,995.00

64" 4-Color DGI Poseidon Sublimation PrinterSpecial Price $39,750.00 Regular Price $54,995.00 -

64" 6-Color DGI Poseidon Sublimation PrinterSpecial Price $48,100.00 Regular Price $62,995.00

64" 6-Color DGI Poseidon Sublimation PrinterSpecial Price $48,100.00 Regular Price $62,995.00 -

Mimaki TS100-1600 - 64" Sublimation PrinterSpecial Price $10,995.00 Regular Price $11,548.00

Mimaki TS100-1600 - 64" Sublimation PrinterSpecial Price $10,995.00 Regular Price $11,548.00 -

Epson SureColor F6470 44" Production Edition Sublimation PrinterSpecial Price $7,695.00 Regular Price $8,195.00

Epson SureColor F6470 44" Production Edition Sublimation PrinterSpecial Price $7,695.00 Regular Price $8,195.00 -

Epson SureColor F6470H 44" Production Edition Sublimation PrinterSpecial Price $8,195.00 Regular Price $8,695.00

Epson SureColor F6470H 44" Production Edition Sublimation PrinterSpecial Price $8,195.00 Regular Price $8,695.00 -

Mutoh XpertJet 1642WR Pro 64” Dye Sublimation PrinterSpecial Price $12,495.00 Regular Price $19,995.00

Mutoh XpertJet 1642WR Pro 64” Dye Sublimation PrinterSpecial Price $12,495.00 Regular Price $19,995.00 -

Mutoh ValueJet 2638WX 104” Dye-Sublimation PrinterSpecial Price $31,495.00 Regular Price $49,995.00

Mutoh ValueJet 2638WX 104” Dye-Sublimation PrinterSpecial Price $31,495.00 Regular Price $49,995.00 -

Mutoh ValueJet 1948WX 75” Dye-Sublimation PrinterSpecial Price $32,495.00 Regular Price $49,995.00

Mutoh ValueJet 1948WX 75” Dye-Sublimation PrinterSpecial Price $32,495.00 Regular Price $49,995.00 -

Mutoh XpertJet 1682WR 64” Dye-Sublimation PrinterSpecial Price $15,495.00 Regular Price $21,995.00

Mutoh XpertJet 1682WR 64” Dye-Sublimation PrinterSpecial Price $15,495.00 Regular Price $21,995.00 -

Mutoh RJ-900X Dye-Sublimation Printer - 44" wideSpecial Price $4,700.00 Regular Price $7,560.00

Mutoh RJ-900X Dye-Sublimation Printer - 44" wideSpecial Price $4,700.00 Regular Price $7,560.00 -

Epson SureColor F570 Pro 24" Desktop Sublimation PrinterSpecial Price $2,745.00 Regular Price $2,995.00

Epson SureColor F570 Pro 24" Desktop Sublimation PrinterSpecial Price $2,745.00 Regular Price $2,995.00